Credit Repair can lead to a perfect Credit Score.

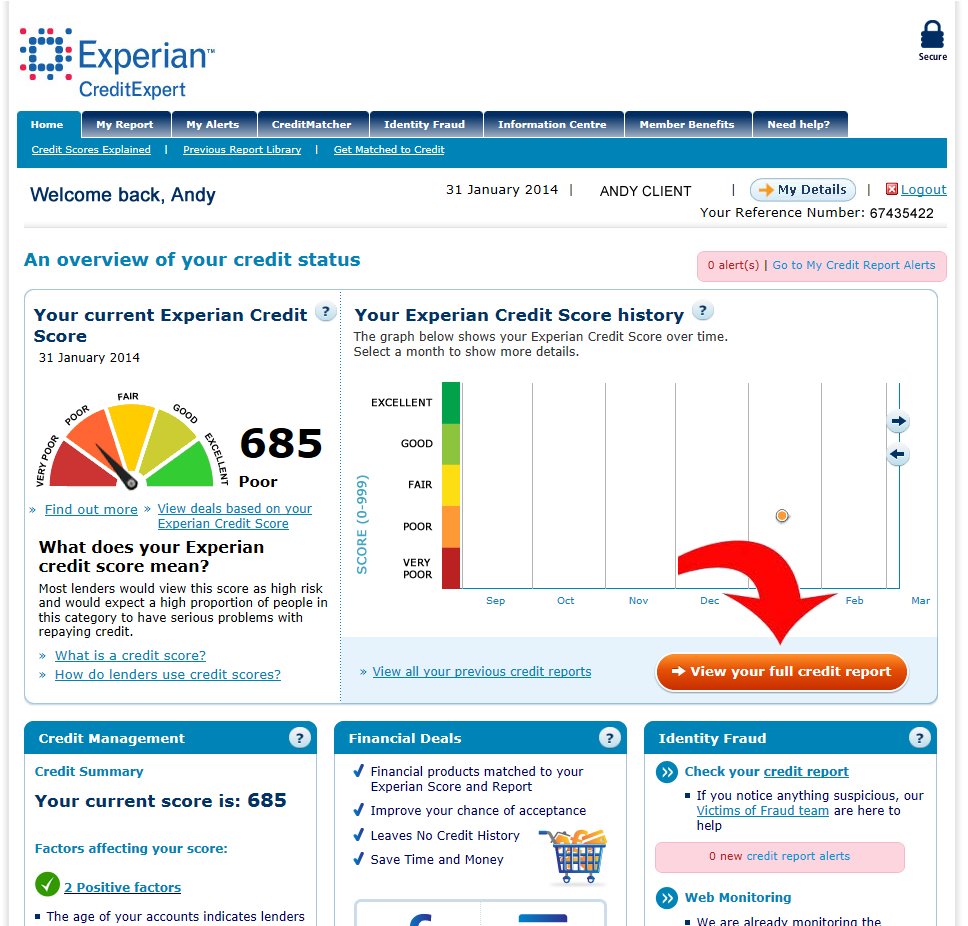

Negative marks on your credit score could be holding you down.

Sometimes perfect credit is only a simple fix. Not everybody needs a complex debt relief program or bankruptcy. It may just be that you have a late payment or two that need to be addressed. Maybe you have an old repossession, a charge off, some medical debt or identity theft issue you need taken care of. Whatever the credit issue is that is holding your credit score down could be fixed. If you Aspire to have 800 credit score or better you should look into what is holding it down!

How to improve your credit score in 3 easy steps

Step 1: Credit Analysis

We can assist you in obtaining your current credit report and complete an in-depth credit review. We can help you identify any mistakes that are potently holding your credit score down so you know what corrective actions need to be taken.

Step 2: Address & Challenge

Once we have helped you identify the inaccuracies and negative items, we can then discuss wither you would like to address them on your own or if you would like us to give you a free quote for us to interact and engage with the creditors and credit bureaus on your behalf. Of course, you will get to verify that the appropriate changes have actually taken place.

Step 3: Score Acceleration and Credit Monitoring

Use techniques that help improve your credit score faster such as having open and active accounts in good standing. Reduce your debt balances below 33 percent of your credit limit and pay your bills on time.